car sales tax illinois vs wisconsin

Just curious if I have to pay Wisconsin sales tax on the car buying at a dealer and Illinois sales tax. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

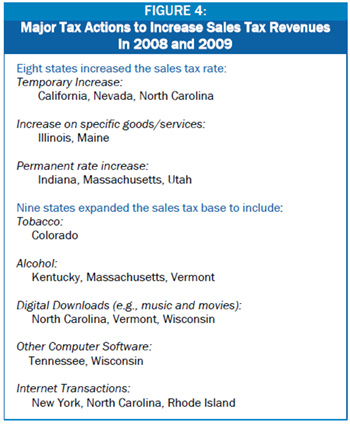

State Tax Changes In Response To The Recession Center On Budget And Policy Priorities

Therefore you will be required to pay an additional 625 on top of the purchase price of the vehicle.

. Car Title Costs in Texas. Just curious if I have to pay Wisconsin sales tax on the car buying at a dealer and. The total tax rate also depends on your county and local taxes which.

Is 10 years old or older. However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against. Avis Car Sales Home Facebook Lets say you have a 250000 tax.

For example theres a state sales tax on the. The state sales tax on a car purchase in Illinois is 625. You can get tax help by using this Web Site calling our Taxpayer Assistance Division.

659 If you try to register the car in Illinois youll have to pay use tax at the time of registration on the difference between the sales tax paid to the state where you. In addition to state and county tax the City of. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

In Wisconsin the state sales tax rate of 5 applies to all car sales. There are also county taxes. For vehicles that are being rented or leased see see taxation of leases and rentals.

775 for vehicle over. There is also between a 025 and 075 when it comes to county tax. More about the Illinois Income Tax.

Car sales tax illinois vs wisconsin Sunday March 20 2022 Edit. ILLINOIS DEPARTMENT OF REVENUE PO BOX 19010 SPRINGFIELD IL 62794-9010 How do I get tax help. 635 for vehicle 50k or less.

Is it better to live in Illinois or Wisconsin. Is it better to live in. Sales of motor vehicles from registered Illinois dealers are taxed.

According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. More about the Wisconsin Income Tax. Side-by-side comparison between Illinois and Wisconsin using the main population demographic and social indicators from the United States Census Bureau.

When Chicago has everything you need as a young professional we forget about Illinois neighbor to the north. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. A motor vehicle purchased out of state and titled and registered in Wisconsin is subject to Wisconsin sales or use tax in the same manner as a vehicle purchased in.

The tax is imposed on motor vehicles purchased or acquired by gift or transfer from another individual or private party. By Travis Thornton May 31 2022.

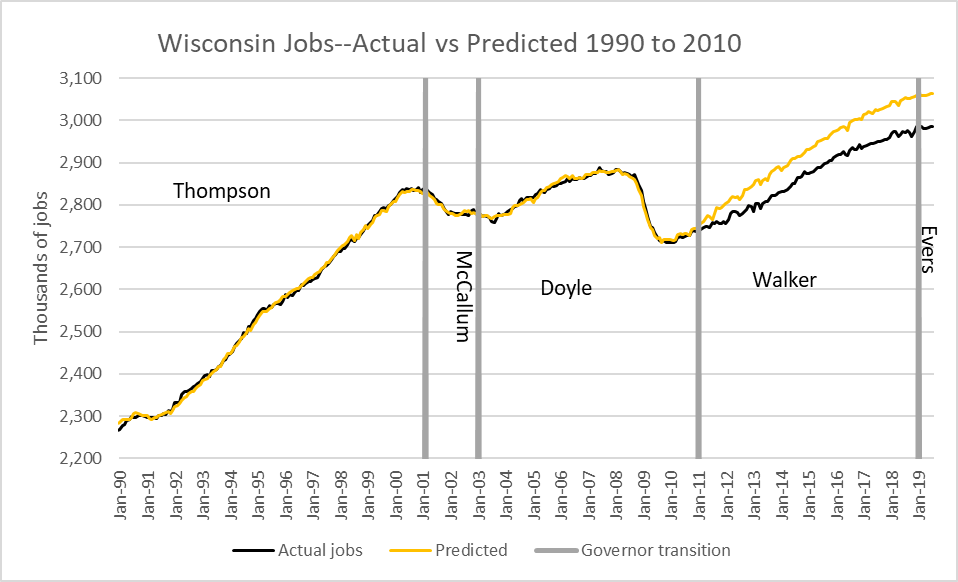

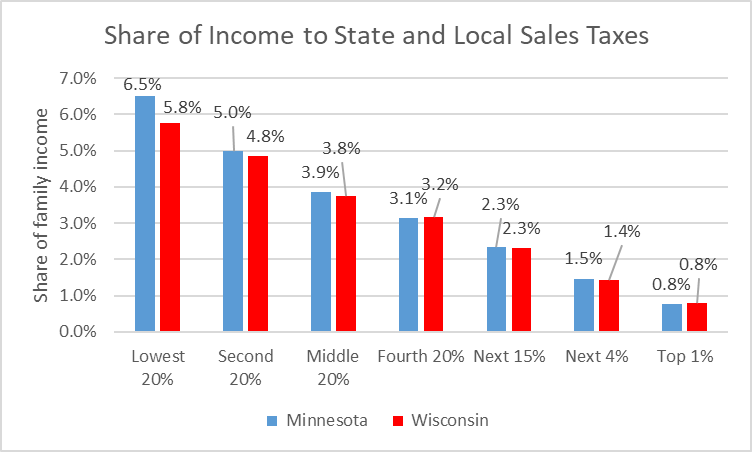

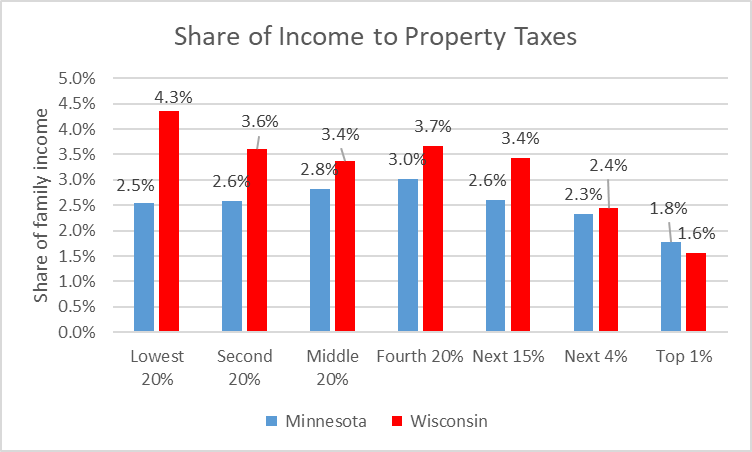

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

Los Angeles Sales Tax Rate And Calculator 2021 Wise

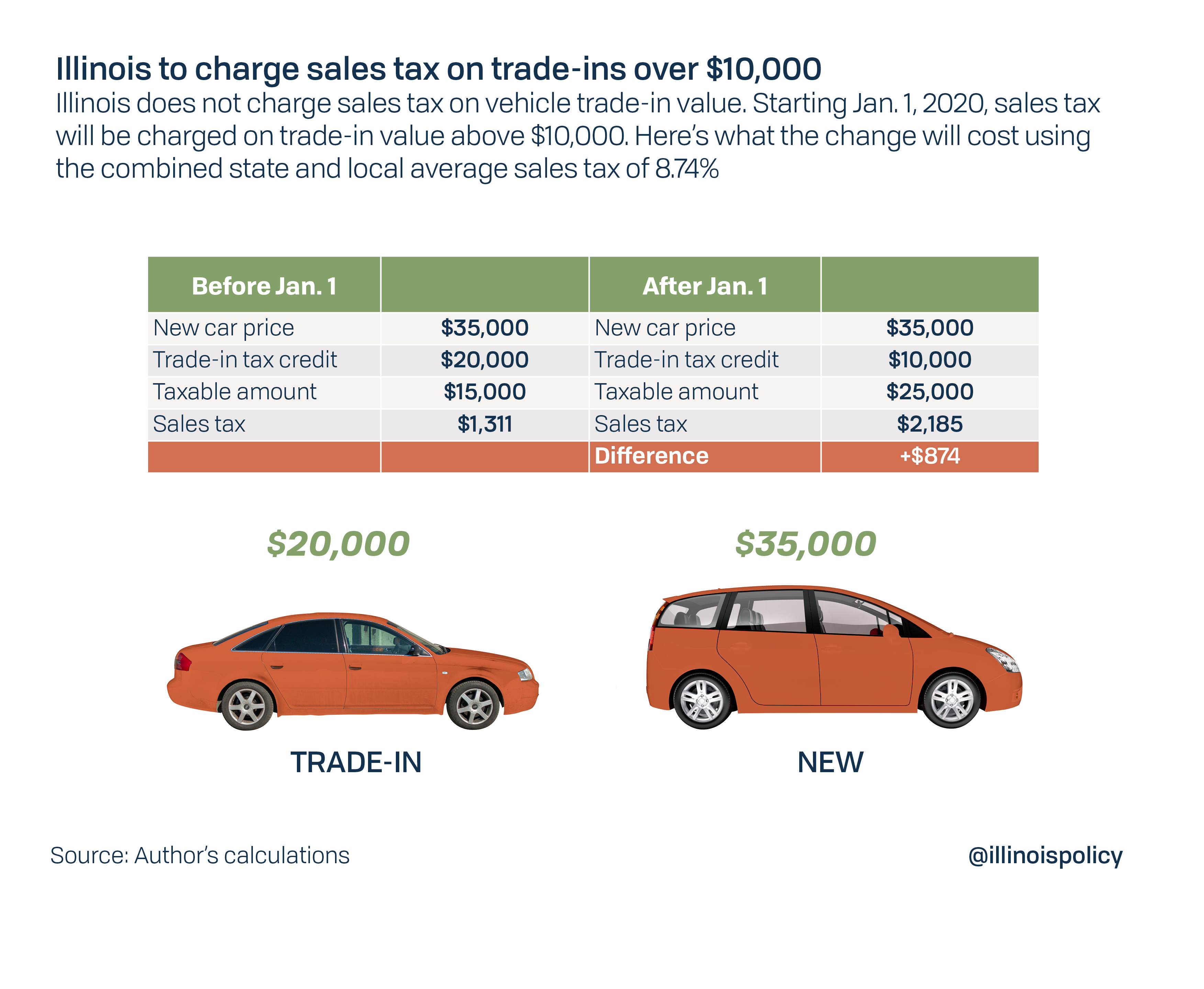

Updates To The 2022 Illinois Trade In Tax Credit Castle Chevrolet

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

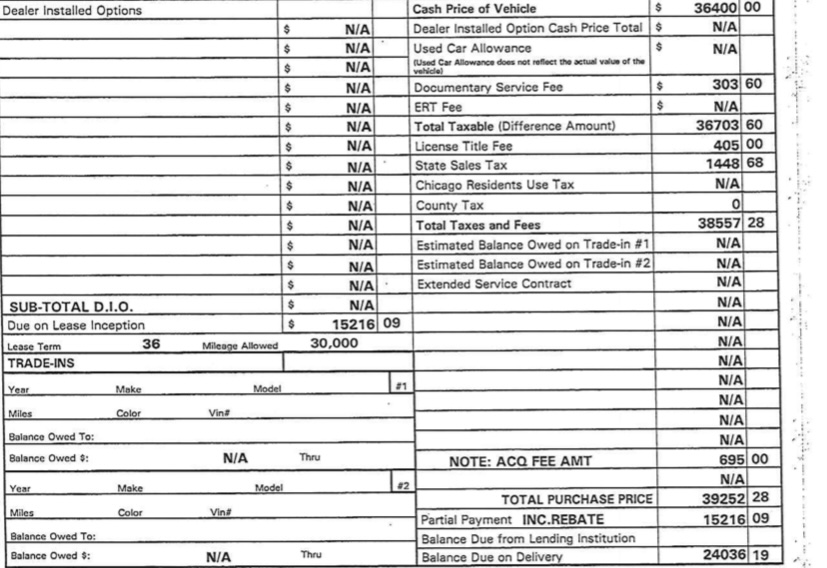

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

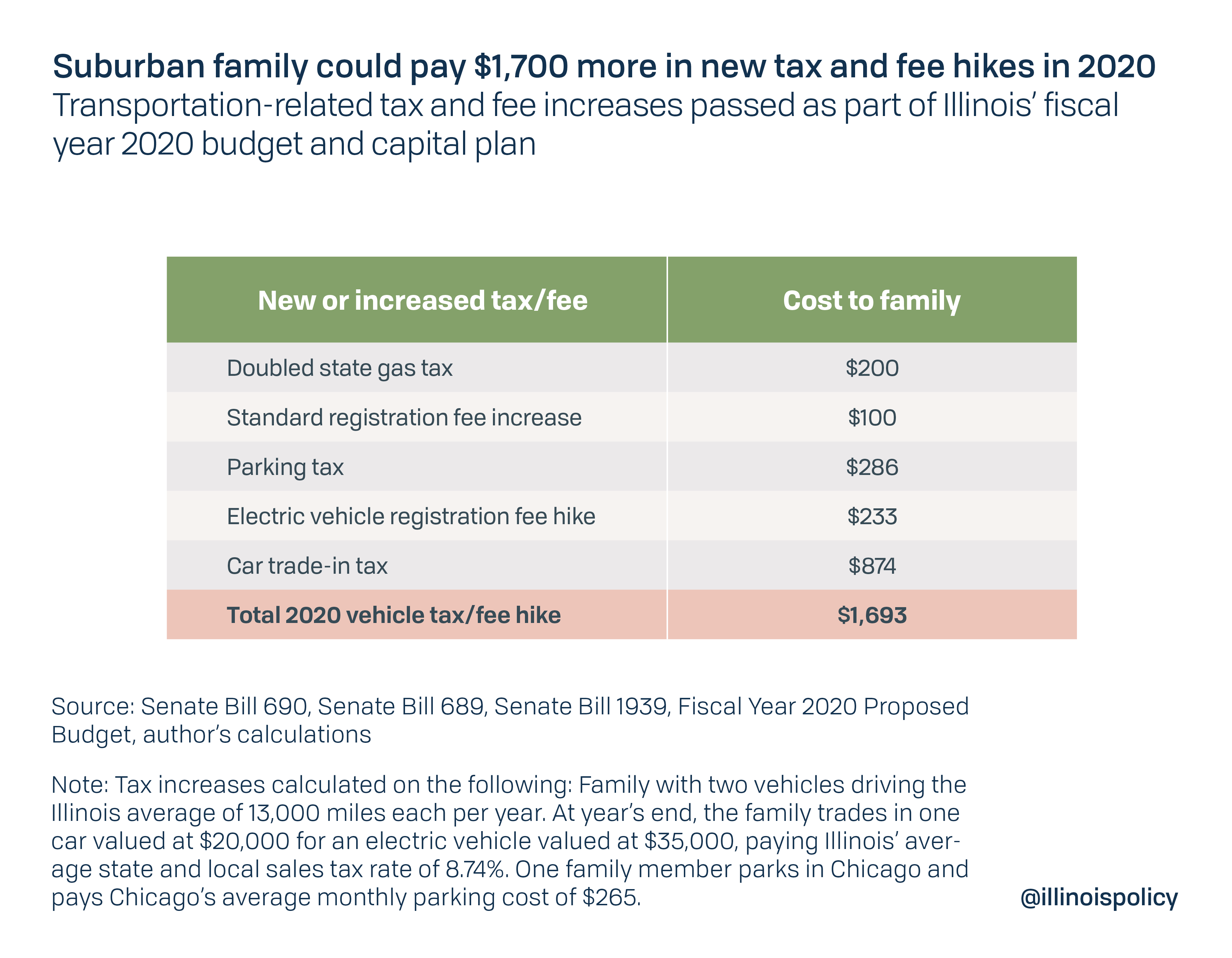

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Sales Tax Hikes Take Effect In 50 Illinois Taxing Districts

Every Electric Vehicle Tax Credit Rebate Available By State

Who Pays Taxes On A Gifted Vehicle Sell My Car In Chicago

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Amnesty Programs By State Sales Tax Institute

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation